ADDITIONAL INFORMATION WITH RESPECT TO THE NEW LEGISLATION FOR THE CHAMBER OF COMMERCE BONAIRE AND THE BUSINESS REGISTER, STARTING JANUARY 1ST, 2022

Since December 1st onwards, the Chamber of Commerce Bonaire has announced and published that effective January 1st, 2022 the revised BES Chambers of Commerce and Industry Act, the BES Commercial Register Act 2009, the BES Commercial Register Decree 2009 and the BES Chambers of Commerce and Industry Elections Decree will be enforced. Based on recent media publications, social media discussions and questions that the Chamber has received directly, we believe it is important to again list an overview of the major changes, and provide some additional explanation on a few aspects.

The changes in the new legislation and regulations mainly apply to:

- The elections of Chamber board members;

- The duties of the Chamber;

- The fees for a number of activities and products, which the Chamber provides.

This legislation is, as usual, prepared by the Ministry of Economic and Climate Affairs, and has been approved by the Dutch Parliament. The purpose of this legislation is to allow the Chamber of Commerce Bonaire (as well as the Chambers of Saba and St. Eustatius) to execute its tasks more efficiently and effectively, and in a way that fits in with the current spirit of the times. The existing legislation had become very much old dated. In performing its duties, the Chamber is required to comply with this legislation, however the Chamber does not decide itself about its content.

As of December 1st of this year, the Chamber has started to inform the registered legal entities and the media of these new legislations and provided an overview of the upcoming changes. For details on the subject they referred to their own website. After this they have highlighted the changes once more, per topic, on their social media and through the press.

Expansion of duties and powers of the Chamber in the new legislation and the role of the Chamber during the Corona pandemic

The Chamber’s duties are expanded with providing information and advice to the Minister of Economic and Climate Affairs, for example supporting the Ministry’s economic policy. Besides this, the Chamber will remain responsible for the Business Register and for providing appropriate advice to entrepreneurship.

Specifically the last two years, during the COVID-19 pandemic, the Chamber has proven to be a valuable partner by encouraging COVID-19 related social-economic support measures for our local entrepreneurs with the Ministries of Economic and Climate Affairs (EZK), Social Affairs and Employment (SZW) and the public entity Bonaire.

Furthermore, the Chamber has assisted significantly in the execution of these measures through the support desk that was set up.

Fees

As per 2022 the annual contribution rates, for organizations registered in the Business Register, will change. The annual contribution will depend upon their legal form (such as sole proprietorship, association, limited or private liability company), and reflects the amount of work required to maintain the Business Register up to date for each specific type of legal form. Experience has shown that there is less work involved in processing the registration of a sole proprietorship than the work required for legal entities such as associations, foundations and limited or private liability companies, mainly due to frequent changes of their board members and changes in their authority.

Furthermore, the present structure of the annual contribution is based on the invested capital, which companies are required to update every year. However, this structure has lead to lots of confusion and companies have shown a very low level of compliance with this legal requirement, which results in an incorrect annual contribution rates being paid by a large group of the registered entities.

The fee adjustment also needs to be considered in light of the fact that these have not been adjusted over the last 10 years. The fees per legal entity are included in the table below:

Starting January 1st, 2022, a distinction will be made between small and large NVs and BVs, depending on the number of registered officers. NVs and BVs with more than one registered officer are considered large companies in view of the increased amount of work involved.

As expected such a change in the structure of the annual contribution rates will have different results for different types of entities. Many companies that are now being charged the lowest fee (‘the sole proprietorship’, which represent more than 25% of the entities registered in the Business Register), will see a reduction in their average fee paid (dependent on their equity) from US$ 89 to US$ 80. The maximum annual fee will decrease from US$ 600 to US$ 400. Overall, this will result in a higher or lower more or less significant change in the annual fee depending on each individual case.

It is evident that the Chamber understands that it is possible that a certain group of entrepreneurs will not be able to pay this fee in one lump sum. Therefore our policy to allow payment arrangements will remain after January 1st, 2022.

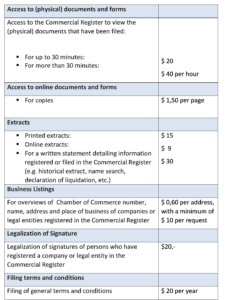

Besides the annual fee the fees for all other products and services of the Chamber have been adjusted and made more transparent for the first time in 10 years. These fees are laid down, starting 2022 in the ‘Financiële regeling handelsregister BES 2002 (stcrt-2021-23103)’ as follows:

Further information

You will find an overview of the consequences of the new legislation on our website, including FAQ and the links to the relevant legislation.