Economy

The most important sector of Bonaire’s economy is and remains tourism. Many people work in tourism or one of its contributing sectors. Bonaire is seeking to diversify its economy by committing to agriculture and the service sector. Economic activity on Bonaire is growing by an average of 2.8% annually. This is also reflected in the growth of the number of companies registering in the Chamber of Commerce’s Commercial Register.

Median income on the island is approximately $25,500 average per person. Due to the COVID-19 crisis this average income will have decreased in the past year. In addition to this, the purchasing power of people on the island shows a slight decrease (source: Trends in the Caribbean Netherlands 2022, Statistics Netherlands (CBS))

Sectors

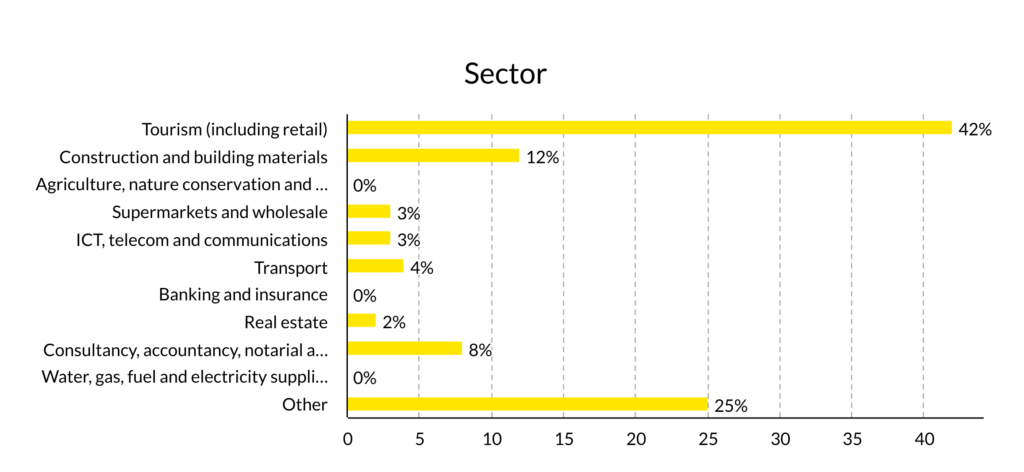

In 2020, the Chamber of Commerce conducted a representative survey among entrepreneurs on the island. The results showed that tourism, construction and the service sector are the island’s main sectors.

In the survey 42% of companies indicated that they are active in the tourism sector. It should be noted that this sector is also a driving force for Bonaire’s economy. Many lines of business within the economy are suppliers for tourism or are dependent upon this sector.

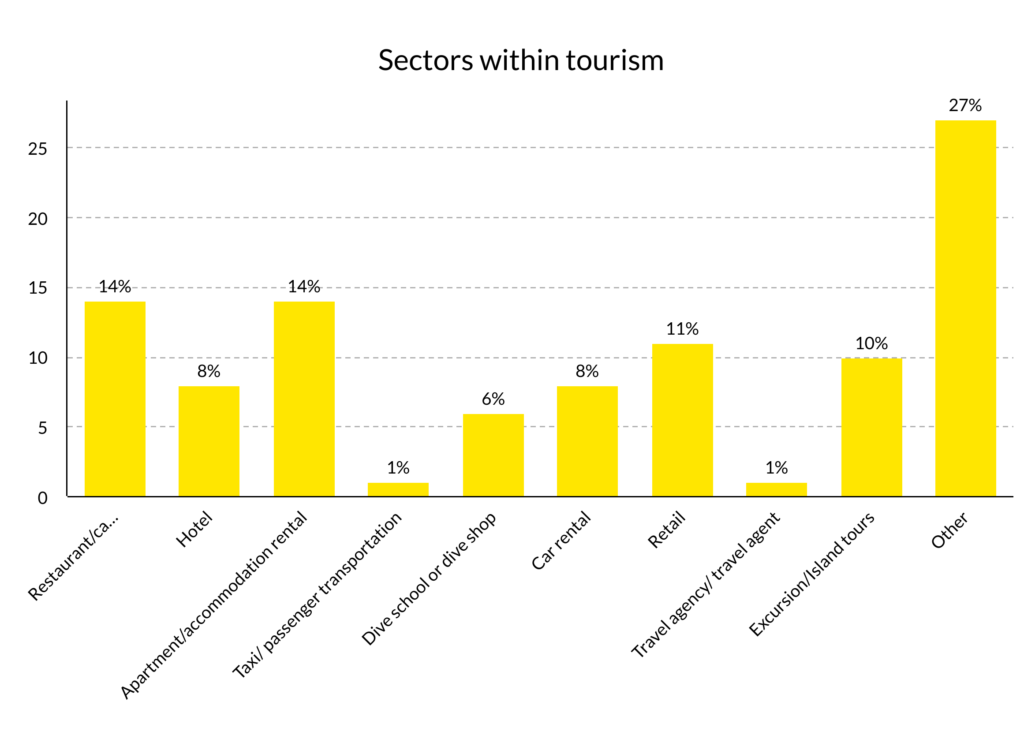

Tourism is the largest sector within Bonaire’s economy. In the CBS study “Trends in the Caribbean Netherlands 2019”, tourism represents approximately 38.4% of the economy. The percentage in the Chamber’s survey is slightly higher. However, the tourism sector was more broadly defined in the survey. Additionally, businesses were asked to specify the sector in which they work within tourism and the table below reflects a good spread among the respondents within the tourism sector.

Taxes

Bonaire is a public entity of the Netherlands. This means that the laws and regulations applied on Bonaire are different to those in the European Netherlands. This includes tax laws and regulations. The most important and most striking differences to the Netherlands taxes are; profit tax (0% rate); dividend tax (5% rate) and wage tax (30.4%). Furthermore, the Caribbean Netherlands applies a property tax with different rates for individuals and companies. It is therefore important to keep informed about the applicable local government rates and surcharges. You may do so via the web link above.